![]()

The table below considers a range of broad methods for or approaches to cost assessment, and the contribution they may be able to make to total cost assessment. Some relate to specific types of effect, while others assist in the calculation of common units, and others in fact provide an overall structure rather than prescribing particular assessment methods. In practice, the tools may not be used in isolation from each other, for instance, Social Impact Assessment (SIA) could well draw in information gathered by physical measurement methods and information collected in Environmental Impact Assessment (EIA). Each of the tools and approaches on the table are discussed below.

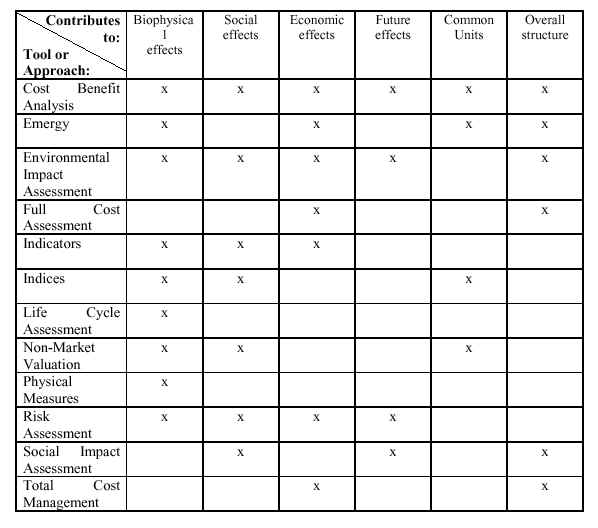

Table A1: Potential usefulness of Tools and Approaches. The table shows the aspects of total cost assessment to which a variety of approaches and tools available may potentially contribute. An `x' denotes potential usefulness. A description of the approaches and tools, including limitations, is provided below. For definitions of effect types, refer to glossary and section 2.5

1. Total Cost Management

Total Cost Management is an approach to the management of costs which has evolved within the private sector in response to changes in the nature of business (Ostrenga et al., 1992). This approach holds that cost management must be based on a solid understanding of cost dynamics, the key to understanding `cost dynamics' being to clarify the relationship between activities and causes, and the relationship between activities and costs. This approach to cost management may be understood in terms of its three key principles, as follows:

1. Business process analysis- Total cost management adopts a process-oriented approach to the management of costs in order to overcome the problem of `division of labour'. A process is defined as a series of activities that lead to the delivery of a service or product (Ostrenga et al., 1992:p.21). `Division of labour' refers to a traditional accounting approach whereby costs are accounted for within departments which only partially contribute to the process of delivering a product or service. For example, in a company which produces a range of five tables, three departments (`Design', `Manufacturing' and `Sales and delivery') may contribute to the process which leads to the sale of tables. If costs are accounted for by Department, it is impossible to assess the cost dynamics for a given table. Accounting for costs in terms of programmes and their associated activities provides for a clear understanding of `cost dynamics'.

2. Activity-based analysis- Within each process, costs are accounted for in terms of the activities which give rise to them. This follows because costs cannot be managed themselves, only the activities which cause costs can be managed. The goal in activity-based costing is to mirror causality in the process of producing a good or supplying a service (Ostrenga et al., 1992: p.30).

3. Performance measurement- To manage costs successfully it is necessary to establish a performance measurement system which mirrors the goals and objectives of the manager. This requires the following:

a) identifying and measuring the `critical success factors' related to the delivery of the product or service (the attributes or activities which are essential to the success of the organisation).

b) developing a performance measurement system which integrates financial and non-financial costs.

c) developing a performance measurement system which reflects the spirit of `continuous improvement' ie. improving the management of costs by incremental steps. For example, when implementing a system of accounting, test and refine the new system using a single product or service. In this way, any changes or refinements (and associated costs) are incurred on a small scale. (Ostrenga et al., 1992:35)

Total cost management can be further described as having the following characteristics:

1. a focus on cost prevention as opposed to reporting

2. provides a direct link between causes and effects

3. a focus on measurements of profitability and cash flows in addition to cost flows and accumulation

4. entails a cost system which includes administration, selling and general costs in `total cost'.

5. allocates overhead costs on a cause and effect basis

6. is a way of doing business as opposed to an accounting system (Ostrenga et al., 1992:p.20)

Potential:

A detailed discussion of total cost management is provided in Ostrenga et al. (1992). In relation to `total cost assessment' (as defined in this study), `total cost management' generally adopts a narrower definition of non-financial costs, being costs which are not financial but which have an impact on financial costs. As noted, it was developed in response to commercial needs, however it seems as applicable to the provision of waste management services and related products. The key concepts of total cost management, such as linking cause and effect and dividing the overall system by the activities which contribute to the process rather simply by management units, have been incorporated into our framework. Total cost management's further potential contribution to total cost assessment for is guiding the use of total cost in waste management decisions, eg. measuring the `critical success factors' related to the delivery of the product or service, developing a performance measurement system which integrates financial and non-financial costs and seeking `continuous improvement'.

Energy-based Systems

Based on the laws of thermodynamics, all physical activities decrease the availability of energy, so that a possible conceptualisation of `cost' is reduction in available forms of energy (Peet, 1992). The LBJ School of Public Affairs developed a specific system which accounts for physical changes in the economy by converting all materials and processes into a common unit of equivalent solar energy (called `emergy'). It uses four main premises:

1. The Universality of Systems (everything is part of a system, systems are interrelated).

2. A common unit is required to compare the relative worth of inputs and outputs.

3. Nature's Subsidy (current financial systems do not relate to the actual environmental goods and service being used)

4. The Maximum Emergy Principle (systems will maximise emergy use). (LBJ, 1987, p 2).

This Emergy system was trialed using the Texas economy, and waste disposal was one unit of the economy which was studied. The emergy unit is converted to dollars to give financial costs and benefits. The calculations for the current waste disposal system found it had a net cost because it diverted emergy from the economy by removing land from `productive use', diminishing water quality though leachate, effectively removing valuable materials though disposal, and using fuel unnecessarily (ibid., pxv). Costs were offset by reuse, recycling and diminished waste collection: "If appropriately recycled, partly by reuse within the economy and partly by dispersal for appropriate incorporation into environmental systems, ...so-called `wastes' become by-product resources" (ibid., p44). Different options for waste disposal ranged form a net cost of $25.7 billion to a net benefit of $9.2 billion to the Texas economy (in 1987 $ US, ibid., p 78).

Potential:

Emergy is a very ambitious system. Its benefits include the conversion of all elements to common units and the calculation of net costs or benefits of each component of the economy, which can be directly converted to monetary units. Its intended use integrates waste management into the economy as a whole and treats the minimisation of waste and implementation of the waste management hierarchy as improvements in the whole economy. The major drawback for its smaller scale use for Christchurch City's solid waste management is the large amount of highly detailed data and technical understanding required. Without external support, it is unlikely to meet the criteria of feasibility for Christchurch City Council because of the expertise which would have to be brought in. Social effects would have to be measured additionally in a separate system.

Full Cost Accounting

Often, accounting or costing systems within public waste management have not recorded the actual costs of programme implementation or attributed costs to particular programmes, resulting in hidden costs and cross-subsidisation of costs (Turner, 1997. p58; MfE, 1996a, p7). Full Cost Accounting (FCA) systems are activity based costing methods which seek to account for all time, equipment, capital, facility and overhead costs of an organisation (Turner, 1997, p58). It is a more comprehensive and systematic application of traditional accounting methods, programme by programme based on their activities.

The USEPA also promote an expanded version called Full Cost environmental Accounting, which combines full cost accounting, environmental cost accounting (ie. accounting of non-financial costs) and life cycle costing. The increasing convergence of financial and non-financial accounting is also illustrated by a recent CICA report on FCA, which proposed that FCA should be "the integration of all costs, both internal and external, resulting from an entity's activities, operations, and products or services", while it is acknowledged that "a more limited scope of FCA may be the best that can be aimed for in the near future" (Willis, 1997, p 49). The wider version of FCA aims for monetisation of all costs (Boone and Rubenstein, 1997, p18).

Potential:

The potential for full cost accounting is great because (in its simple form) it does not require any new or specialised accountancy skills (Turner, 1997, p59). In New Zealand there are also supports such as the Landfill Full Costing Guideline (MfE, 1997). In our framework, full cost accounting is the method we assume for the calculation of all financial effects.

The fuller sense of FCA would be reflected to some extent in the complete implementation of our programme, including both full cost accounting of financial affects, and assessment of ecological and social effects, as well as the inclusion of information regarding the long term effects of different substances, particularly in landfill (as discussed in section 4.4.5). The major limitation on this fullest implementation of FCA is the lack of market prices (or even transactions in the commercial sense - Luscombe, 1997, p3) for many environmental and social effects which need to be accounted for, and the potential confusion that inclusion of such information within `financial' assessment may cause (Willis, 1997, p49).

Life Cycle Assessment:

"Lifecycle Assessment (LCA) consists of a systems analysis of the lifecycle of a product or service. It considers all of the inputs to the system, in terms of resources (materials and energy) and all the outputs of the system, in terms of the emissions to air, water and land" (ERRA, 1997, p4). LCA first defines system boundaries, then makes an inventory analysis (that is, identifies and quantifies all material and energy flows into and out of the system), which is then interpreted for its impact, and finally opportunities for environmental improvement are identified (ibid.). The usual application is to one commercially produced product, from `cradle to grave', but it is now beginning to be applied to various products within one main step of their lifecycles (eg. waste management).

Potential:

ERRA has developed a model for applying LCA for integrated waste management, placing system boundaries to include post-generation to disposal. At present it has only limited inclusion of ecological effects of waste management, and none of social and economic effects (ERRA, 1997, p 10). The major application of LCA as it is currently done is as a basis for understanding the waste management system, rather than for costing per se. The type of process modelling done in this report (see figure 7) does reflect this approach. A very significant potential contribution of LCA to the understanding of total cost would be its application to specific types of waste to plot their different impacts through the waste stream and end disposal.

Environmental Impact Assessment

Environmental Impact Assessment (EIA) can be defined as the "official appraisal of the likely effects of a proposed policy, program, or project on the environment; alternatives to the proposal; and measures to be adopted to protect the environment." (Gilpin, 1995). EIA has been designed provide a systematic analysis of effects to be used for improved, strategic policy making. "In principle, EIA should lead to the abandonment of environmentally unacceptable actions and to the mitigation to the point of acceptability of the environmental effects of proposals which are approved. EIA is thus an anticipatory, participatory environmental management tool"(ibid).

In New Zealand, the RMA introduced EIA as a central element within the policy process towards sustainable management. Section 88 (4)(b) states that applications for resource consent "shall include an assessment of any actual or potential effects that the activity may have on the environment, and the ways in which any adverse effects may be mitigated". The elements of the Assessment of Effects on the Environment (AEE) are described in the Forth Schedule of the Act.

In practice EIA is often restricted to effects on the ecological environment, but theoretically encompasses social and economic aspects as well (Caldwell, 1987, p7). The approach incorporates the tools appropriate to the issue in question. These can be tools such as qualitative descriptions, ecological measurements, social surveys, cost-benefit-analysis, non-market valuation and risk assessment.

Although there is no uniformity in how to implement EIA, the following elements of the EIA process can be identified:

(Wood, 1995)

Consultation and public participation as well as the mitigation of environmental impacts at each of the elements is integral to the process.

Potential:

To some extent the nature of EIA is similar to TCA (as we define it). Both approaches are designed to integrate social, biophysical and economic aspects. Also, both approaches use a variety of tools, appropriate to the issue in question. However, there are also differences, especially with regard to the application in practice. EIA is most commonly carried out during the planning and implementing stages of projects, where as TCA is continuously carried out, eg. annually as envisaged in the CCC Draft Waste Management Plan. EIA is mostly applied to assess biophysical and (to a lesser extend, but increasingly) social aspects, while economic aspects are usually not regarded (see for example Wood, 1995). In contrast, it is - by definition - crucial for TCA that all, social, biophysical and economic effects are captured. Although it is not sufficient to use EIA instead of TCA, EIA provides a useful and important approach within TCA, especially with regard to assessing biophysical effects.

Social Impact Assessment

Social Impact Assessment (SIA) is similar to EIA and can be regarded as its subset. Taylor (1995) provides a detailed discussion of SIA in New Zealand. He defines SIA as "a process of research, planning and management to deal with social change arising from intended and current policies and projects. It is focused on individuals, groups, communities and sectors of society affected by change, although its focus is usually local and regional. It is a process that uses social analysis, monitoring, and methods of public involvement." Indeed, public participation through cooperation, coordination and communication among all affected is seen as fundamental to the approach, providing a tool for proactive policy making.

Taylor defines six main steps within the SIA process:

| Scoping | Identification of issues, variables to be described/measured, links between bio-physical and social variables, likely areas of impact, and study boundaries |

| Profiling | Overview and analysis of current social context and historical trends |

| Formulation of alternatives | Examination and comparison of options for change |

| Projection and estimation of effects | Detailed examination of impacts of one or more options against decision criteria |

| Monitoring, mitigation and management | Collection of information about actual effects, and the application of this information by the different participants in the process to mitigate negative effects and manage change in general |

| Evaluation | Systematic, retrospective review of the social effects of the change being assessed including the social assessment process that was employed |

Potential:

The potential for SIA to be used as a framework for TCA is closely linked to that of EIA. SIA is most important at the stage of planing and implementation and of the closure of projects, and is thus different to the continuous nature of TCA. Most important, in contrast to TCA, SIA is only concerned with social effects and does not assess biophysical and economic effects which have no direct social effect. Thus, it can only be used for the assessment of some effects, ie. social effects within TCA. However SIA is a valuable and necessary in this respect.

Risk Assessment

Risk can be defined as "exposure to the possibility of such things as economic or financial loss or gain, physical damage, injury or delay, as a consequence of pursuing a particular course of action", and can relate to both human and non-human communities (MfE, 1996b, p1). The assessment of risk can include:

The evaluation of risk can be done quantitatively or qualitatively. The quantitative approach estimates probability of the occurrence and evaluates its consequences, simplified in the formula below (where R is risk, p is probability and L is loss):

R = p x L

Qualitative risk assessment recognises that there is often a large gap between this `scientific' risk assessment and the public understanding of the same risk. It therefore focuses on identifying personal perceptions of the risk. Both forms of risk assessment can be utilised in risk management, which is the decision making and action taken to reduce the identified risk.

Potential:

The limitations of risk assessment include the fact that (since it deals with uncertainty) it is often based on imperfect understanding and assumptions, and cannot be considered a `precise science' (Gerrard, 1995, p304). A major drawback for its use in total cost assessment as considered in this study is that it is used almost exclusively for the assessing and managing the potential of negative occurrences or costs, rather than benefits (ibid., p 301). The major potential for risk assessment for a total cost framework is its use in estimating future costs (or benefits) which may be faced. Risk assessment is also likely to be used within waste management in the comparative assessment, design and management of major developments such as landfills or hazardous waste facilities (in which case, it is a cost accounted for within the total cost of waste management).

Non Market Valuation

Non-market valuation (NMV) techniques are used to assess the value of goods and services which do not have market prices ascribed to them currently. They aim to make this valuation in monetary terms. There are three main types of NMV:

Travel Cost Method (TCM)

This method uses travel costs as a proxy for the willingness to pay to visit a site. The higher the travel costs people are willing to pay, the higher the site is valued. And, the higher the travel costs, the fewer visitors to the site. According to travel costs and number of visitors, a demand curve can be derived. The method is useful to value (open access) recreational sites, historic sites and wilderness areas. It is not useful in waste management because people do not gain benefit from visiting waste management sites.

Hedonic Pricing (Property Value Approach)

This approach values environmental goods by tracing the effect of environmental quality on property prices. The method is based on the economic concept that the value of a property is directly related to the present value of the expected stream of benefits, including environmental benefits. A requirement is that people use the property and are therefore affected by the surrounding environment. Therefore, the method is often applied to residential housing. In waste management, for example, the price of land for residential housing next to a refuse station can be compared to the price of land away from the refuse station (with other influencing variables accounted for).

Contingent Valuation Method

Using the Contingent Valuation Method (CVM), the consumer is asked what he/she is willing to pay for a non-market good. It is based on the assumption that consumers reveal their true willingness to pay (WTP). In contrast to the Travel Cost Method and the Property Value Approach which use surrogate markets, CVM asks consumers directly about their preferences for non-existing markets. Like WTP, the willingness to accept (WTA) compensation for loss of non-market goods can be measured. CVM can be used to gain information about people's WTP for benefits of waste management or for the avoidance of costs of waste management. For example people could be asked about their WTP for the collection of their waste (ie. for the avoidance of the costs which would occur if the waste were not collected). Likewise, CVM can be used to elicit the WTA costs of waste management or the loss of benefits of waste management.

CVM has important limitations because it is based on a hypothetical market. The respondents' determination of their WTP is open to the following biases:

For further readings see Bjornstad and Kahn (1996), James (1994), and Winpenny (1991).

Potential:

NMV is useful because it expresses costs and benefits for which there are no market prices in monetary units, allowing for greater use of money as common units within a total cost assessment. An important debate continues within economics about the appropriateness of using NMV methods to calculate all types of value in monetary terms (Portney, 1994, p3). Winpenny (1991) claims that some items are simply unmeasurable by economics (such as biodiversity - p.72). While the matrix in table A1 shows NMV as evaulating biophysical effects, this is only done indirectly, through social values of those environmental effects. Apart form methodological limitations, the major restrictions on the usefulness of NMV for total cost assessment will be this issue of appropriateness and the availability of resources, as NMV requires high expertise, at least in the design stage. Where TCM and hedonic methods are inappropriate, the contingent valuation methods must be used which require a large scale of study for accurate results. Although CVM can (theoretically) be applied to most values, it cannot cover intrinsic and future values.

Cost-Benefit Analysis

"Cost Benefit Analysis (CBA) is an information system that has evolved to assist decision makers to compare social welfare under varying states of the world. It is an extension of the financial analysis undertaken by business firms to determine the profitability of different investments. Instead of maximising profits, CBA is concerned with social welfare and uses the social cost of inputs and social benefits of outputs instead of the purchase and selling prices of inputs and outputs used in financial analysis" (Kerr and Odgers, 1987, p.67)

The social values are calculated using NMV where they are not already in monetray terms. At its simplest, CBA involves the calculation of net benefit (ie. benefit less cost) for use as a decision tool (eg. do not carry out projects with a negative net benefit, if choosing between options choose the one with the highest net benefit). CBA typically considers all costs and benefits of a project or activity within a given time frame. Costs occurring in the future are usually preferred to present costs. Conversly, benefits occurring now are preferred to future benefits. In order to value future costs and benefits adequately compared to present costs and benefits, future costs and benefits are discounted. Usually all costs and benefits over the time frame are calculated into net present value (NPV).

A range of variables used could be flawed, so sensitivity analysis is used to see how the outcome varies depending on the data used. This is important to ensure potentially distorting influences are identified. Hanley and Spash (1993: 20) define the following six parameters which need to be include in the sensitivity analysis:

Potential

The potential of CBA for TCA, especially as a charging tool, is theoretically immense, since it attempts to assess all effects in monetary terms. However, it relies heavily on NMV and therefore inherits all its limitations. From table A1 it would appear that CBA can measure all types of effects. However, it must be noted that biophysical effects are only measured by the social values placed on them, rather than by the physical or ecological impacts themselves. Because CBA is only concerned with allocative efficiency, not with aggregated utility through improvement of distribution, using CBA means accepting the current distribution as optimal. A sensitivity analysis with different weights on values of particular groups within society can mitigate this problem, though the choice of the weights are subject to value judgement. Discount rates used vary not only depending on the general current economic situation, but also depending on how heavily the preferences of future generations are considered, and considerably alter the outcome. Again, the limitation can be mitigated through sensitivity analysis, however, an adequate social discount rate is particularly important in environmental decisions, because environmental damage is often irreversible.

Indicators

"Indicators are information tools. They summarise data on complex environmental issues to indicate the overall status and trends of those issues" (MfE, 1997c, p4). Essentially, an indicator is a measurement that is taken as a representative of a larger system or whole. For example, a small pond may have a species of plant that exists at certain levels when the pond is healthy and normal, but flourishes when fertilisers pollute the pond. Measuring that species therefore provides a benchmark of the biophysical and ecological state of the pond overall. Indicators can also be used for social systems (for instance the economy, using gross domestic product or consumer price indexes).

Indicators simplify complex information, convert it to a form which is comparable over time and communicate it in a meaningful way. The National State of the Environment Indicators Programme is working towards a standardised set of indicators, on the basis that they can: measure the extent to which policy goals are being met; contribute to sustainable management and understanding of the effects of our actions; focus attention on key issues; link environmental impacts and socio-economic activity; provide early warning of problems; and guide the gathering of environmental information (ibid.).

However, there are some limitations of indicators. They simplify information, and therefore cannot describe all aspects of every environment. It is difficult to find reliable indicators for some systems, and the nature of some issues mean they would not be appropriately or accurately represented through an indicator. Physical and social systems are dynamic, and changes in them aren't always attributable to a particular cause, especially in the short term (ibid.).

Potential

The main advantage for Christchurch City Council of using indicators would be a reduction in the number of measurements which have to be made, and an increase in the understandability of information to decision makers and the public. However, the selection of meaningful indicators is a difficult process requiring some level of specialised experience. The development of the national set of indicators should assist the Council by providing reliable indicators and allowing for comparison and (potentially) coordination and support with other councils.